Continued investments in network improvement strengthens Digi’s Q2 performance

Continued investments in network improvement strengthens Digi’s Q2 performance

- Driving digitalisation through high-speed internet propositions

- Continuous modernisation to future-proof customer touchpoints and improve operational efficiencies

SUBANG JAYA, 15 July 2022 – Digi.com Berhad (“Digi”) today announced its FY2022 second quarter results, delivering a steady quarter on the back of improved network performance, catering to customers’ increasing digitalisation needs.

Digi continued investments in strengthening its network quality and availability, with CAPEX amounting to RM175 million, or CAPEX-to-total revenue ratio of 11.4% in the quarter under review. This supported the company’s commitment to deliver high-speed connectivity and improved quality of experience to its customers, as demand for data continued to surge. Total data traffic rose 4.9% Y-Y, while monthly average data per user stood at 21.9GB. Average download speeds further improved to 44.1 Mbps from 42.2 Mbps in the last quarter, reflecting the company’s network leadership position and its commitment to providing the fastest and most consistent network experience to its customers.

Digi also expanded its 4G LTE and LTE-A network coverage, which now serves 95% and 78% of populated areas nationwide respectively, alongside an extensive fibre network of 10,346KM across the nation.

Digi’s stronger network quality, coupled with improved efficiencies and focused execution of its business strategies generated healthy subscriber base growth in its core segments. Postpaid subscribers grew for the seventh consecutive quarter, with 183K Y-Y net additions to a total of 3.36 million subscribers, as a result of attractive bundling offers anchored on Digi’s high-speed internet proposition. Prepaid subscribers returned to growth with 96K Y-Y net additions to 7.13 million subscribers. Blended mobile ARPU remained resilient at RM42.

Continued growth in demand for Digi Fibre yielded net additions of 16.4K Y-Y subscribers, while ARPU lifted RM20 Y-Y to RM127, underlining healthy contracting and strategic upselling activities. Digi Business also maintained its growth trajectory, increasing its subscriber base by 17.4% Y-Y and revenue by 13.0% Y-Y from higher demands for both core and beyond core connectivity services, as the company accelerated Malaysian businesses with advanced and trusted digital solutions.

Digi’s Acting Chief Executive Officer and Chief Marketing Officer, Praveen Rajan said, “Good traction in our fibre and business segments reflects our ability to deliver to the growing need for reliable, high-speed connectivity as digital adoption among consumers and businesses accelerates. To support this digitalisation drive, we continue to invest into modernising our network and expanding access to connectivity. This sets us in the right pace and direction as we commit to delivering better quality of internet experience for our customers, in line with JENDELA’s aspirations, as well as powering Malaysia’s digital economy agenda.”

Resilient Q2 2022, with sequential service revenue growth and healthy margins

Digi’s service revenue improved 1.3% Q-Q to RM1,325 million in the second quarter of 2022, reflecting the company’s sharp execution of its strategies to drive growth in Postpaid, Prepaid, Fibre and B2B segments.

Financial highlights for Q2 FY2022

- Postpaid revenue up 0.2% Q-Q on healthy demands for smart bundles, B2B and broadband

- Prepaid recovered 0.2% Q-Q for the first time after 3 quarters supported by resilience in Malaysian segment, stabilisation of migrant segment and higher data demands

- Fibre and digital revenue up 40.0% Q-Q and 21.7% Q-Q, respectively, fuelled by high demand for faster connectivity and gaming activities through trusted Digi brand

- Device revenue at healthy level of RM214 million to drive sustainable postpaid growth

- EBITDA (boi) up marginally 0.1% Q-Q to RM742 million or margin of 48.2%, attributed to topline growth, disciplined handset subsidies and efficient cost containment

- Profit After Tax (PAT) down 6.8% Q-Q on higher net finance costs from non-cash hedge accounting and deferred tax effects

- Second interim dividend of 2.8 sen per share, equivalent to RM218 million of dividend pay-out

Operational highlights for Q2 FY2022

- Total mobile subscriber base grew 267K Q-Q to 10.49 million as both postpaid and prepaid subscribers registered healthy net additions of 41K and 226K, respectively

- Internet subscriber base stood at 86.9% of total base, with smartphone penetration rate reaching 92.6%

- Improved 4G performance now supporting 69% Voice-over-LTE (VoLTE) traffic as a result of efficient spectrum utilisation

Affordable, high-speed internet products supporting consumer and businesses’ digitalisation needs

- Launched Juara Internet Sinaranku, a Ramadan and Raya exclusive promo, and Juara Internet Familiku, with limited-time offers for families to enjoy free smartphones and tablets alongside great savings across Digi’s range of Prepaid, Postpaid and Fibre products

- Enhanced B2B digital solutions for SME, including special deals on roaming and devices, as well as a new talent acquisition tool, OZ, available via Digi’s altHR app, through a partnership between Digi-X and People Psyence ®

Driving Responsible Business best practices

- Empowering Malaysians to protect themselves against scam and fraud through simplified educational resources

- Partnered with local artists to launch comic series as a fun approach to continue raising awareness on internet safety tips

- Continued advocacy on creating healthy and conducive digital environment for children

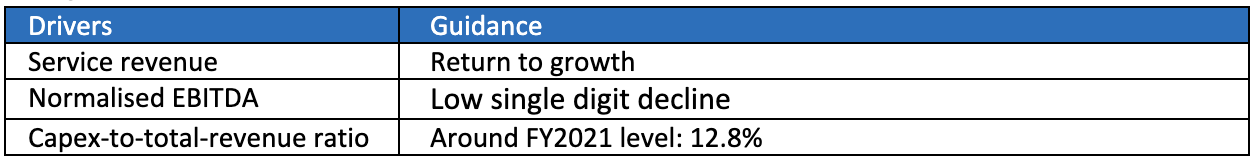

2022 guidance

Digi’s 2022 guidance is revised as follows after taking into consideration the global inflation outlook and rising interest rates:

More on Digi’s Q2 2022 performance is available here.